What is GomyFinance.com Credit Score?

GomyFinance.com credit score is a digital tool that helps you take full control of your financial health. It shows you how lenders see your creditworthiness based on your past financial behavior. The score ranges between 300 and 850, like most credit score range (300–850) models.

The platform uses your payment history, credit utilization ratio, and other financial data from bureaus like CIBIL score, Experian Boost, and Equifax report. This gives you a complete picture of your credit standing and what steps to take next.

Why You Should Check Your Credit Score

When you check credit score online, you get clear insight into how your money habits impact your loan or credit card eligibility. Using a free credit score tool like GomyFinance lets you know where you stand without any cost.

Whether you’re applying for a mortgage, personal loan, or car loan, a good credit score meaning lower interest rates and faster approvals. That’s why it’s essential to use a credit score tracker regularly.

How Credit Scores Are Calculated

Your score is made up of several parts. Here’s a breakdown:

| Factor | Impact (%) |

| Payment history | 35% |

| Credit utilization ratio | 30% |

| Length of credit history | 15% |

| Types of credit used | 10% |

| New credit inquiries | 10% |

As you can see, making payments on time and keeping balances low are crucial. These two alone make up 65% of your total score.

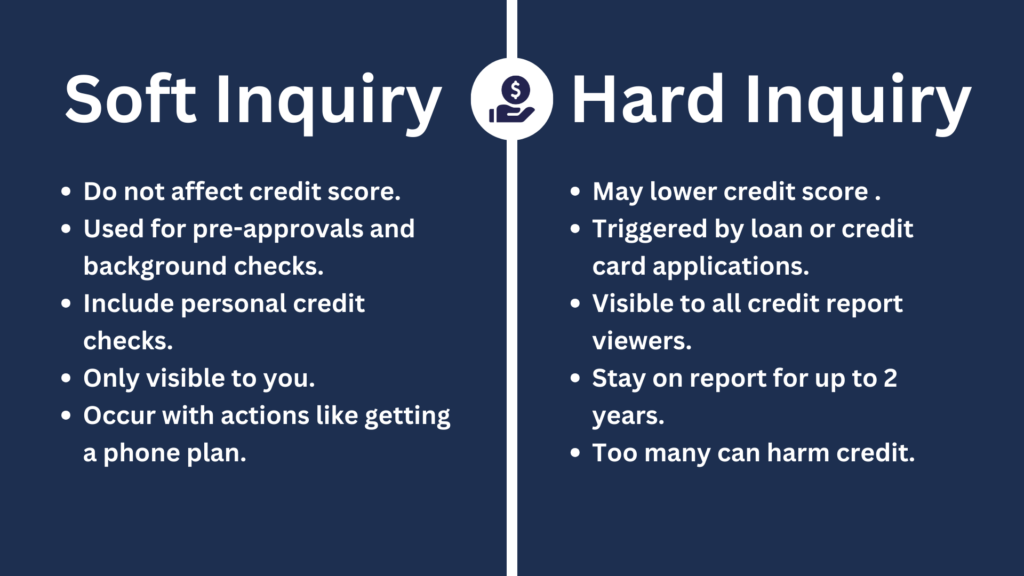

Soft Inquiry vs Hard Inquiry

Every time you apply for a new loan or credit card, lenders perform a hard inquiry. This can drop your score slightly. But checking your own score through credit score app like GomyFinance is a soft inquiry, which doesn’t impact your rating.

Knowing the difference between soft inquiry vs hard inquiry helps you avoid unnecessary drops in your credit score.

Understanding Credit Reports: CIBIL vs Experian vs Equifax

Your credit score is built from reports generated by credit bureaus. The three main bureaus are:

- CIBIL/Experian credit report

- Equifax report

- Experian Boost

Each one may have slightly different information, so it’s smart to check all three. GomyFinance lets you monitor these through credit monitoring tools.

How to Improve Your Credit Score

Improving your credit rating isn’t complicated, but it does take consistency. Here are five effective tips:

- Always pay bills on time (payment history)

- Keep your credit utilization ratio under 30%

- Avoid frequent hard inquiries

- Dispute any errors through credit dispute process

- Use budgeting tools and apps to manage finances

These habits will gradually lead to a stronger credit profile and better chances of loan approval.

Importance of Financial Planning

Credit health is closely tied to good money management. Financial planning helps you avoid overspending and stay prepared for emergencies.

Start with financial goal setting and use a budget template to stay on track. Set short-term and long-term goals so you know where to focus your income.

How to Create a Budget Using GomyFinance

GomyFinance offers tools to help you create a budget that fits your lifestyle. With its intuitive dashboard, you can:

- Categorize expenses easily

- Calculate monthly budget

- Get personalized financial insights

- Adjust in real-time based on spending patterns

This helps you stay in control while improving your credit.

Budgeting Tips That Boost Your Score

Budgeting isn’t just about spending less. It’s about track expenses and seeing where your money is going.

Here are some smart budgeting tips:

- Use apps to automate savings

- Monitor income vs expenses weekly

- Set alerts for bill due dates

- Include loan EMIs in your monthly planning

- Review and revise your budget monthly

Tracking Expenses for Better Credit Health

Expense tracking is key in building credit. If you overspend and miss payments, your score will suffer. Use budgeting using GomyFinance to make it easier.

You can track spending on:

- Rent and utilities

- Subscriptions

- Groceries

- Credit card bills

- EMIs and insurance

Staying on top of this helps maintain a healthy credit utilization ratio.

How GomyFinance Credit Score Tracker Helps

GomyFinance’s credit score tracker is a powerful tool. It not only shows your score but gives personalized suggestions to raise it.

With credit health management, you can:

- Receive alerts on changes

- Monitor your progress monthly

- Understand how your actions impact the score

- Learn from tailored recommendations

Using GomyFinance’s Credit Monitoring Tools

The platform offers smart credit monitoring tools that go beyond just numbers. They offer insights into improving your financial profile.

Whether it’s detecting fraud, sending due date alerts, or updating score changes, these tools keep you protected and informed.

Fixing Credit Issues Through Disputes

Found an error on your report? File a credit dispute directly. GomyFinance guides you through the process.

Sometimes reports show incorrect defaults or wrong personal info. Resolving these helps you recover lost points fast.

Achieving Long-Term Financial Goals

Your credit score affects your ability to buy a home, start a business, or get the best loan deals. That’s why financial goal setting is so vital.

With GomyFinance, you can set, monitor, and revise goals based on real-time data.

Final Thoughts: Take Charge of Your Credit Health

Your GomyFinance.com credit score is more than a number. It reflects your money habits, spending behavior, and financial mindset.

Use tools like the credit score app, credit score tracker, and budgeting tools and apps to get ahead. Learn to track expenses, create a budget, and boost your credit health management with smart choices.

When you take control of your credit, everything else becomes easier—from loans to life goals.

FAQs

1. How often should I check my credit score online?

You can check it every month using GomyFinance’s free credit score tool without affecting your score.

2. Can Experian Boost really help improve credit score?

Yes, Experian Boost adds positive utility payment data to your file, which may help increase your score.

3. What’s the ideal credit utilization ratio?

Keep it under 30%. For best results, aim for 10% or lower.